For any shipment bound for Europe, the cost picture has shifted. Beyond sea freight and customs duties, importers now face charges tied to the carbon emissions of the goods and the packaging that accompanies them. The EU’s Carbon Border Adjustment Mechanism (CBAM) and the Packaging and Packaging Waste Regulation (PPWR) together make packaging a measurable cost and a compliance item for customs and buyers. This matters whether you ship electronics, appliances, furniture parts, or industrial components: packaging type, material composition, and end-of-life handling now factor into the landed cost and the buyer’s decision. Choosing packaging that lowers embedded emissions and increases recycled content is no longer optional for high-volume sellers — it is a practical way to reduce tariffs, avoid delays, and keep margins steady.

The New Green Trade Barriers

International trade now carries a clearer environmental price tag. Two regulatory fronts are most important to packaging teams and procurement managers: CBAM, which prices embedded carbon, and PPWR, which defines recyclable content and packaging rules.

What Exactly is CBAM?

CBAM is the EU mechanism that records — and will price — the greenhouse gas emissions embedded in products imported into the EU. Initially applied to energy-intensive sectors, CBAM is moving toward wider coverage; importers must collect emissions data and prepare for certificate purchases when the transitional phase ends and enforcement widens. For packaging teams, the practical implication is that high-carbon packaging materials such as old-style expanded polystyrene may increase the CBAM cost assigned to the overall shipment if emission data is reported or default values apply. Reporting accurate material and manufacturing data is now a component of customs risk management.

Before discussing material choices, it helps to see how PPWR complements CBAM. While CBAM prices emissions, PPWR shapes what packaging is acceptable in the EU market. Together they shift buyer requirements, forcing procurement and packaging teams to rethink suppliers, materials, and lifecycle data. The next section summarizes the PPWR rules you must track.

PPWR’s Mandatory Requirements for Packaging

PPWR raises the bar on recyclability, recycled content, and packaging design. The regulation sets minimum recycled-content targets for many plastic packaging types, requires packaging to be recyclable, and calls for traceability and clear data about material composition. The measure also encourages simpler material mixes and recovery routes so that recyclers across EU member states can process packaging more reliably. Expect buyers and compliance teams to ask for documented recycled content percentages and proof of recyclability when qualifying suppliers.

Why this matters to your packaging choices

- Default emission values used by authorities can be conservative, raising the effective CBAM cost if real data is missing.

- Non-recyclable or mixed-material packaging can fail PPWR conformity and lead to market restrictions.

- Buyers are adding sustainability criteria to supplier evaluation, increasing the procurement premium for compliant materials.

REPS: Your Compliance Passport

REPS — recyclable expanded polyethylene / enhanced EPS technologies offered by HUASHENG — is positioned as a material that meets the twin pressures of lower embedded emissions and stronger recyclability. It addresses questions procurement teams now ask: “What is the recycled content? Can this be reclaimed in EU streams? How much carbon is embedded per cubic meter?”

Below we examine the two most practical advantages of REPS: recycled content that aligns with PPWR requirements and measurable lifecycle emissions benefits that lower CBAM exposure. Each subsection explains how the material delivers value in real procurement and logistics contexts.

Recycled Content Directly Meets Regulations

PPWR calls for higher recycled content in many plastic packaging categories. REPS formulations from HUASHENG are marketed with stable incorporation of recycled feedstock and consistent bead quality. For buyers, this reduces the documentation friction when declaring recycled percentages and removes uncertainty when passing supplier audits.

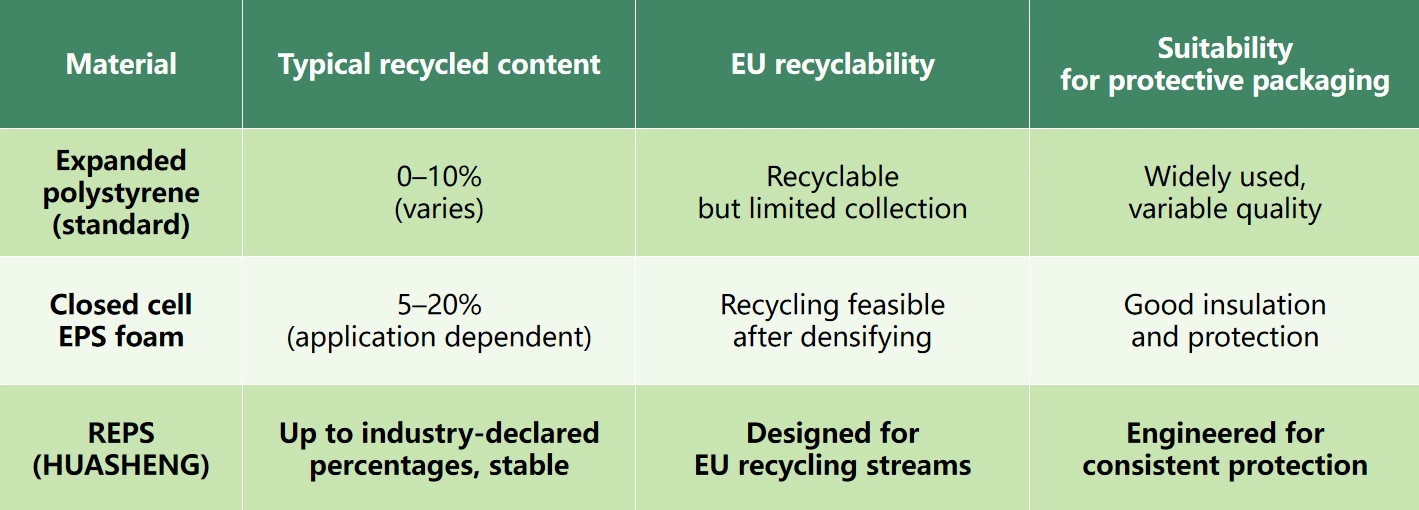

Quick comparison:

Benefits for procurement and customs:

- Easier reporting of recycled content in PPWR declarations.

- Lower risk of customs applying high default emission values under CBAM.

- Fewer product holds and faster supplier qualification.

Reduce Carbon Footprint Across the Entire Lifecycle

CBAM looks at embedded emissions. REPS reduces those emissions at three practical stages:

- Material Sourcing: Incorporating recycled material reduces upstream emissions compared with virgin polymers.

- Manufacturing: Modern pre-expansion and molding lines consume less energy per cubic meter than older lines, lowering production emissions.

- End-of-Life: REPS is designed to be densified and returned to recycling loops; stronger recycling pathways reduce the emissions attributed to disposal or incineration.

A real example from supplier testing: customized REPS solutions have been reported to cut damage rates in transit substantially, reducing returns and the embodied emissions of replacement goods. Lower damage rates and lighter pack density also reduce transport emissions per product. Those combined effects shrink the CBAM-relevant carbon figure declared at import.

Turn Compliance Costs into Long-Term Value

Regulation need not be only a cost center. With the right material and partner, compliance can stabilize costs and improve commercial outcomes.

The following subsections explain concrete business benefits: how reducing compliance risk can protect margins and create new procurement advantages, and how packaging decisions feed into a brand’s credibility with European customers and procurement teams.

Avoid Risks Is Creating Revenue

Reducing CBAM and PPWR exposure avoids unpredictable costs:

- Fewer surprise charges from default emission factors.

- Reduced chance of shipment holds because of missing recyclability documentation.

- Lower damage-related returns and replacement shipping.

For example, an electronics shipper sending 20,000 units per year who reduces packaging-related freight and damage costs by 12% could save over $40,000 annually on logistics and claims alone. For high-volume buyers, these savings compound and improve bid competitiveness.

Enhance Your Brand’s Green Image

European buyers increasingly score suppliers on sustainability. Firms that document recycled content, show end-of-life plans, and supply lifecycle data move higher on buyer lists. Procurement surveys show a meaningful share of organizations already setting supplier sustainability targets and collaborating to improve supplier performance; these trends influence tender outcomes and long-term contracts. Presenting REPS data and certifications shortens procurement cycles and supports better commercial terms.

Choose HUASHENG Beyond a Supplier Relationship

Selecting a material is only part of the solution. A supplier that provides consistent data, testing, and joint problem-solving becomes a strategic asset.

HUASHENG positions itself not merely as an EPS foam block supplier or REPS bead supplier, but as a partner that supplies verifiable data, supports testing, and helps integrate packaging decisions into broader export and sustainability plans.

Provide Verifiable Environmental Data

HUASHENG publishes product pages, technical notes, and case examples that document material properties, recycled content targets, and production processes. For customs and audits, the availability of consistent manufacturing and emissions data cuts the risk of default CBAM values being applied. When importers can attach supplier declarations and lifecycle reports to their customs filings, the CBAM exposure is measurably lower.

A Strategic Partner for the Future

HUASHENG’s REPS offering includes customizable bead sizes, density ranges, and closed-cell formulations suited to specific loads and fragility needs. For large buyers seeking stable supply from EPS foam suppliers or REPS bead suppliers, this means predictable performance, batch consistency, and tailored material that fits EU recyclers’ handling requirements.

What to ask your supplier (quick checklist):

- Can you provide recycled content certificates and mass-balance statements?

- Do you track energy use and emissions per ton of product?

- Is the REPS material accepted by recyclers in the EU, and do you have recovery partners?

- Can you provide drop-test results and damage-rate case studies for my product type?

Conclusion

Global trade regulations are raising the stakes for packaging teams and procurement managers. CBAM attaches a carbon price to imports; PPWR demands recyclable packaging and documented recycled content. Together, these rules change the calculus for any exporter shipping to Europe. Choosing REPS, supplied with verifiable data and designed for recyclability, gives exporters a way to lower embedded emissions, reduce CBAM risk, and meet PPWR requirements while preserving packaging performance.

For high-volume buyers, partnering with a supplier that supplies traceable data and tailored REPS solutions smooths customs, lowers cost volatility, and strengthens procurement credentials in Europe. Contact HUASHENG now at info@r-eps.com to discuss specifications, batch data, and pilot runs that can demonstrate measurable savings and lower regulatory exposure.